Get FREE IK Multimedia Quad Image on April 30th at Bedroom Producers Blog

Bedroom Producers Blog will give its readers 25,000 free IK Multimedia Quad Image licenses at 2 p.m. (CET) on Tuesday, April…

Basic Music Theory For Music Producers

Music theory can seem daunting for self-taught musicians and producers, particularly when you haven’t had any formal musical education. However,…

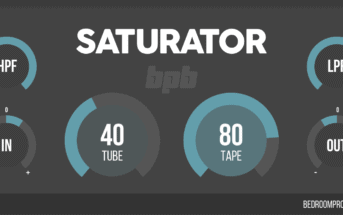

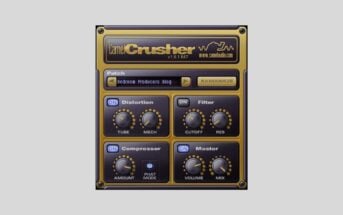

Free EQ VST Plugins

These are the best free EQ VST plugins for mixing and mastering. For more free software, return to our VST…

14 Best Gifts For Music Producers In 2023

We tested the best gifts for music producers in 2023. Refer to our guide below if you want music production…

A Guide To Mixing Music For Music Producers

If you’d like your music to sound radio-ready, you must understand the basics of mixing. Our essential guide to mixing music…

Brainworx Heritage Bundle – Get 10 Classic Brainworx Plugins For Under $50

For a limited time, Plugin Boutique offers an exclusive bundle called the Brainworx Heritage Bundle. The collection features 10 classic Brainworx plugins for just…